Business News England - 15.11.2021

Help to Grow your business

Small business leaders can now register their interest in Help to Grow Management, a 12 week-programme delivered by leading business schools across the UK. Designed to be manageable alongside full-time work, this programme will support small business leaders to develop their strategic skills with key modules covering financial management, innovation and digital adoption.

Who is it for?

UK businesses from any sector that have been operating for more than 1 year, with between 5 to 249 employees are eligible.

The participant should be a decision maker or member of the senior management team within the business e.g. Chief Executive, Finance Director etc. Charities are not eligible.

See: Help to Grow – Take your business to the next level (campaign.gov.uk)

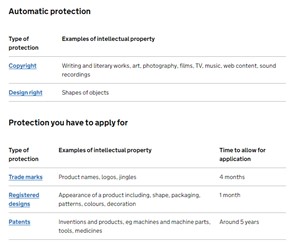

Intellectual property and your work

Protecting your intellectual property makes it easier to take legal action against anyone who steals or copies it. The type of protection you can get depends on what you have created. You get some types of protection automatically, others you have to apply for.

For more guidance see: Intellectual property and your work: Protect your intellectual property - GOV.UK (www.gov.uk)

Return to your claim for the Self-Employment Income Support Scheme

A Section has been added with links to guidance for the fifth grant and previous grants. A link to guidance on how to pay back a grant has also been added.

You can use the online service to check the status of your payment, update your details, see how much you were paid or if you think the grant amount is too low.

If you have made a claim, HMRC will check your details and pay your grant into your bank account in the next 6 working days. They will send an email when your payment is on its way.

Contact HMRC if you haven't heard from them after 10 working days since you made your claim and you've not received your payment in that time.

If you've received a letter from HMRC stating you need to pay back some or all of the grant then see a new section which been added to the guidance called 'Check how to tell HMRC and pay money back'. You can use the service to check whether you need to tell HMRC and pay back a grant.

See: Return to your claim for the Self-Employment Income Support Scheme - GOV.UK (www.gov.uk)

Applying for Advance Assurance before Raising Venture Capital

HMRC have updated their guidance to companies applying for Advance Assurance that the company seeking finance qualifies for one of the generous venture capital tax reliefs that are currently available.

Individual investors may obtain an income tax deduction of 50% if the company qualifies for Seed Enterprise Investment Scheme (SEIS) or 30% income tax relief where the company qualifies for EIS relief. In addition there is potentially a CGT exemption when the shares are sold and also deferral or relief from CGT on other disposals. Although not mandatory, Advance Assurance that the company and trade qualifies for tax relief may encourage more external investors to invest in the company.

There are numerous detailed conditions that need to be satisfied for the company to qualify and lots of details such as business plans need to be supplied to obtain Advance Assurance. HMRC will not comment on whether a particular investor would qualify for relief, however the company will normally be required to give details of potential investors for HMRC to consider the application. Note that the generous tax reliefs are not normally available to an investor who is connected to the company, typically an existing employee or someone who will own more than 30% of the company's capital.

The HMRC guidance also covers Advance Assurance that the company qualifies under the Social Investment Tax Relief and Venture Capital Trust rules.

Applications for Advance Assurance may be emailed to: enterprise.centre@hmrc.gov.uk.

Or alternatively posted to the HMRC Venture Capital Reliefs Team.

For updated guidance see: Apply for advance assurance on a venture capital scheme - GOV.UK (www.gov.uk)

Innovate UK Smart Grants: Autumn 2021

Smart is Innovate UK's 'open grant funding' programme. It provides an opportunity for UK registered organisations to apply for a share of up to £25 million to deliver disruptive research and development (R&D) innovations that can significantly impact the UK economy.

All proposals must be business-focused. Applications can come from any area of technology and be applied to any part of the economy, such as, but not exclusively:

- the arts, design and media

- creative industries

- science or engineering

Innovate UK welcomes projects that overlap with the Industrial Strategy grand challenge areas, but this is not a requirement.

See: Competition overview - Innovate UK Smart Grants: October 2021 - Innovation Funding Service (apply-for-innovation-funding.service.gov.uk)

Biomedical Catalyst 2021: round 2 competition

Innovate UK, part of UK Research and Innovation, will invest up to £12 million for businesses to develop innovative healthcare products, technologies and processes.

This competition combines two strands of the Biomedical Catalyst:

- Feasibility Award - this award is designed for projects that have developed an innovative concept or carried out experimental proof of concept but have not validated the technology.

- Primer Award - this award is for conducting a technical evaluation of an idea through to proof of concept in a model system.

Your project must focus on the development of a product or process that is an innovative solution to a health and care challenge. Your project can focus on:

- disease prevention and proactive management of health and chronic conditions

- earlier and better detection and diagnosis of disease, leading to better patient outcomes

- tailored treatments that either change the underlying disease or offer potential cures

See: Competition overview - Biomedical Catalyst 2021 Round 2: Feasibility & Primer Awards - Innovation Funding Service (apply-for-innovation-funding.service.gov.uk)

EUREKA GlobalStars Taiwan: digital industrial collaborations

Innovate UK, part of UK Research and Innovation, is investing up to £865,000 to fund collaborative research and development (R&D) projects focused on industrial research.

The funding will be awarded through a EUREKA Globalstars competition to facilitate collaboration between UK and Taiwanese businesses and encourage innovation and deployment of novel digital technologies for manufacturing.

See: Competition overview - EUREKA GlobalStars Taiwan digital industrial collaborations - Innovation Funding Service (apply-for-innovation-funding.service.gov.uk)

How KG Accountants can help

Everything you need to know about setting up and running your social enterprise.

The Specialist services we offer to Community Interest Company include:

The above list of services is not exhaustive. We are pleased to offer advice and assistance on any CIC matters

Arrange a FREE initial consultation.

0207 953 8913

How we can help

Call us today on 0207 953 8913 or complete our enquiry form in order to book a FREE initial consultation.